|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Loan Online: A Comprehensive GuideUnderstanding Home Loan RefinancingRefinancing your home loan online can be a strategic financial move, offering potential benefits like reduced monthly payments or a lower interest rate. When done correctly, it can enhance your financial situation considerably. What is Refinancing?Refinancing involves replacing your current mortgage with a new one, usually to improve the loan terms. This can be particularly advantageous when 'mortgage interest rates today' are lower than your original rate. Benefits of Online Refinancing

Steps to Refinance Your Home Loan Online

Common Challenges and How to Overcome ThemFinding the Best RatesIt can be challenging to find the best rates. Consider checking out '15 year mortgage rates' for potentially lower interest options. Understanding Fees and CostsBe aware of closing costs and fees that may be associated with refinancing. It's crucial to factor these into your decision-making process. FAQWhat are the main benefits of refinancing online?Refinancing online offers convenience, the ability to compare multiple offers quickly, and often faster processing times than traditional refinancing. How can I ensure I'm getting the best rate?To secure the best rate, maintain a good credit score, compare multiple lenders, and consider different loan terms, like a 15-year mortgage. Are there any risks associated with refinancing online?Potential risks include not fully understanding the terms or costs associated with refinancing, which can be mitigated by thorough research and consultation with financial advisors. https://yourhome.fanniemae.com/calculators-tools/mortgage-refinance-calculator

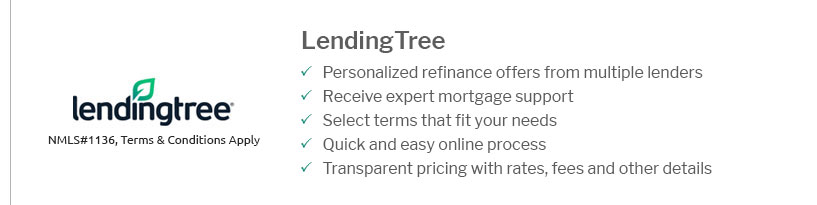

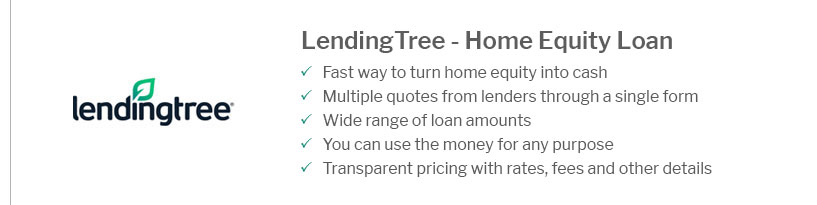

internet device. If ... https://www.lendingtree.com/home/refinance/

Best refinance lender overall: Rate - Best online mortgage refinance experience from a traditional bank: Chase - Best for online refinance rate transparency: ... https://www.usbank.com/home-loans/refinance/cash-out-refinance.html

An application can be made by calling 888-291-2334, by starting it online or by meeting with a mortgage loan officer. Minnesota properties: To guarantee a ...

|

|---|